• 5 min read

Founder vs Professional Management: How leadership impacts returns

Public markets tend to reward short-term execution. But many of the companies that compound value the longest are led by people who think in generations, not quarters.

How management structure impacts long-term investor returns

Management structure shapes how a company balances growth, risk, and returns. Founder and family-led firms often reinvest profits and focus on sustained growth initiatives, while professional managers may prioritize quarterly targets to meet board or analyst expectations. Understanding who is in control gives investors insight into whether a company is likely to pursue sustained growth or maintain steady short-term performance.

Curious whether a company is led by its founder? Check out our Founder Operator Indicator to see which stocks have active founders today.

The main management structures explained

Founder-led companies: long-term vision and growth. These firms are run by the original entrepreneur, who often has a personal stake in long-term success and tends to think in decades, not quarters. They typically reinvest profits into growth and innovation, and their vision shapes company culture and strategy, giving the firm a distinctive identity.

Family-led companies: succession and sustained growth. Controlled by descendants or relatives, these companies maintain a long-term perspective and strategic continuity. Family dynamics and succession planning can create challenges, but the family connection often aligns goals with sustainable growth and legacy preservation.

Family-owned firms: long-term vision with professional management. Here, professional executives handle daily operations while the family retains ownership and strategic influence. This structure combines long-term orientation with operational discipline, formal governance, and scalability.

Professional management: efficiency and scalability in non-family firms. Professional managers run both operations and strategy. These firms focus on efficiency, short- to medium-term profitability, and accountability, often excelling in operational rigor and succession planning, though they may lack the personal long-term stake of founders or families.

Founder vs professional management: performance trends

Studies show that founder-led companies often outperform firms run by non-founders over the long term. A U.S. study from 1993 to 2002 found that firms with founder CEOs earned annual excess returns of 8.3 percent, and 4.4 percent after adjusting for industry and firm characteristics (Granite Firm, 2023).

Analyses of S&P 500 founder-led firms reinforce this trend. Over 15 years, these companies generated roughly three times the total returns of other firms, reflecting their sustained growth orientation and long-term focus (Bain, 2023); (MoneyWeek, 2023).

Founder-led firms also show disciplined capital allocation. They often hold higher cash reserves and invest steadily in growth-related activities, increasing financial flexibility and resilience. Family-led companies demonstrate similar advantages, maintaining performance and stability even during economic stress (PMC, 2023). Leadership structure, especially founder involvement, gives investors insight into a company's growth strategy, resource allocation, and ability to weather market cycles.

Strengths of founder and family-led companies

Founder and family-led firms often take a long-term view, prioritizing growth and innovation over short-term earnings. They tend to invest steadily through economic cycles, maintaining key initiatives even during downturns.

Consistent leadership helps preserve culture, strengthen employee loyalty, and support stable decision-making. These qualities contribute to their resilience, patient capital allocation, and potential for sustained long-term growth.

Risks of founder and family-led firms for investors

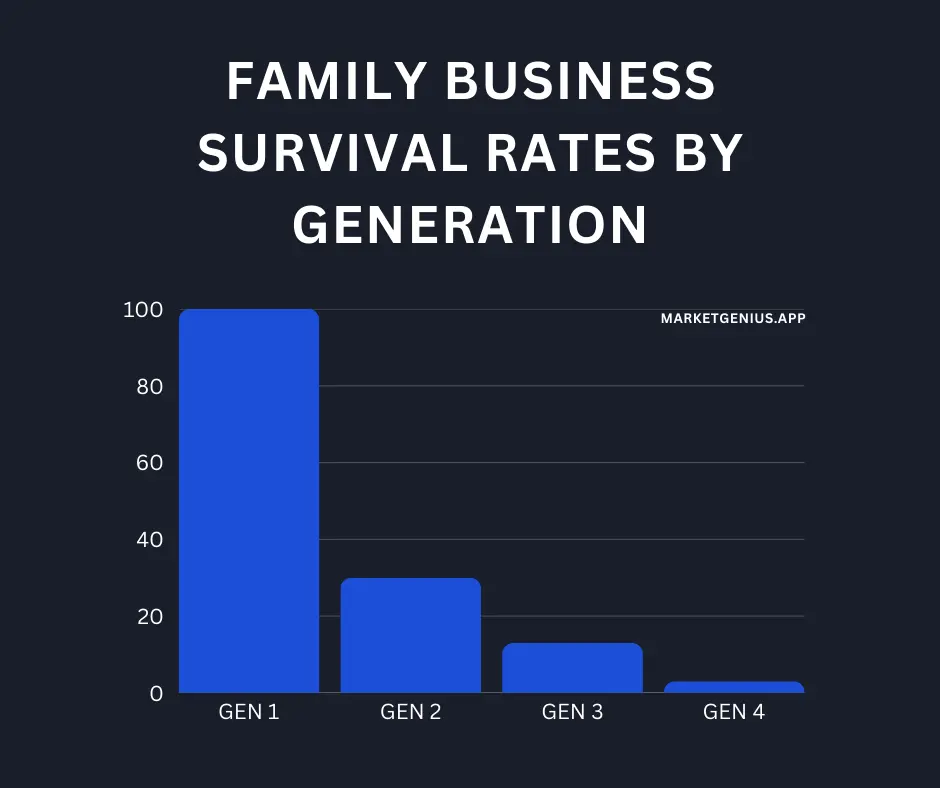

Founder and family-led firms face key-person and succession risks. Performance often depends on a single leader or family, and unexpected departures can disrupt strategy and investor confidence. Succession is particularly challenging. Only about 30% of family businesses survive the transition to the second generation, 12–15% to the third, and fewer than 3% reach the fourth generation (Business Initiative, 2023).

Governance is often less formalized than in professionally managed firms, which can lead to over-centralized decision-making, resistance to new ideas, and difficulty adapting to changing markets. Recognizing these risks helps investors weigh long-term strengths against potential vulnerabilities.

Strengths and weaknesses of professionally managed firms

Professionally managed firms are run by executives hired for their experience and expertise rather than ownership. They bring operational discipline, formal governance, and a focus on efficiency, which helps companies scale and execute strategies consistently.

These firms often excel where short-term execution, risk control, and meeting quarterly expectations are important. Structured processes and clear performance metrics reduce dependency on any single individual and support smooth leadership transitions.

While they may lack the personal long-term stake of founders or families, professionally managed companies often outperform in industries that demand operational rigor, standardized procedures, or global expansion.

Leadership and returns: key takeaways

Management structure is a helpful filter, not a rule. Founder and family-led firms often suit long-term investors in industries that benefit from vision and patient capital. Professionally managed firms tend to excel in scalable, process-driven sectors.

Company stage also matters. Early-stage firms often rely on founder leadership for adaptability, while mature companies may depend on professional managers for efficiency and global execution. Combining structure with fundamentals, valuation, and industry context gives the clearest picture of risk and growth potential. Understanding who runs a company signals its time horizon, risk approach, and capital allocation priorities, helping patient investors make more informed decisions.

Conclusion: lessons on management structure and growth

Management structure shapes how companies grow and allocate capital. Founder-led firms drive long-term vision, family-led firms bring resilience and continuity, and professionally managed firms excel at efficiency and scalability. Understanding who runs a company gives investors a lens into its priorities, risk approach, and growth potential, helping match leadership style to investment horizon and strategy.