• 4 min read

P/E Ratio: The expensive truth about cheap stocks

Why higher P/E stocks can actually be the better long-term investment.

Explainer

A stock's Price to Earnings Ratio (P/E) tells you if a stock is expensive relative to how fast it is actually growing.

In general, a lower P/E suggests you are paying less for each dollar of earnings - though high-growth companies often justify higher ratios.

How to read P/E numbers

P/E numbers typically fall into three ranges:

- P/E below 15: Potential value opportunity or mature/slow-growth business

- P/E 15-25: Fair value range for most established companies

- P/E above 25: Premium pricing that requires strong growth to justify

These ranges serve as general guidelines, though different industries have different norms.

Formula

A P/E ratio is calculated by dividing a stock's price by its earnings per share (EPS).

Example

This example shows two companies with the same stock price but with different P/E multiples.

| Company | Stock Price | Current Earnings Per Share (EPS) | P/E Ratio | 5-year EPS Projection |

|---|---|---|---|---|

| Company A (Fast growth) | $100 | $4 | 25 | $4 × 1.25^5 = $12.21 |

| Company B (Mature business) | $100 | $8 | 12.5 | $8 × 1.05^5 = $10.21 |

Surprised? Company A's EPS of $12.21 beats Company B's EPS of $10.21 after 5 years. You paid double the P/E ratio but got 20% more earnings per share.

In our example, Company A (P/E 25) justified its premium pricing through superior earnings growth, while Company B (P/E 12.5) delivered steady but slower earnings growth.

Put your P/E knowledge to work

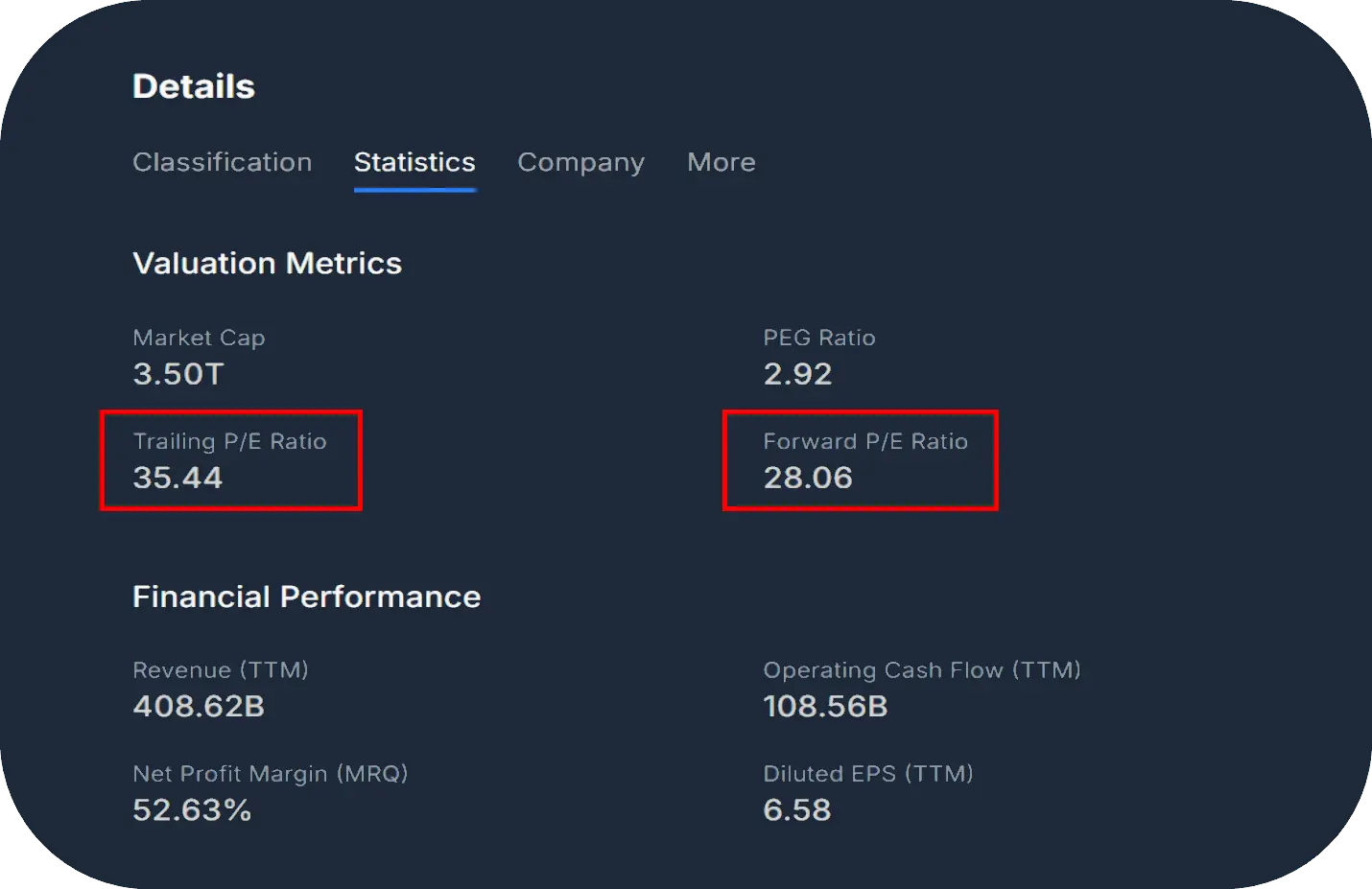

Search any stock on our Stock Page to instantly see its P/E ratio, growth rates, and whether you're getting a good deal.

Why P/E beats earnings growth alone

The reason P/E is the better indicator is because earnings growth rates only show how fast a company is expanding but ignore what price you are paying for that growth.

- Valuation determines your actual returns

- A company growing earnings 20% with P/E 40 might give worse returns than one growing 10% with P/E 10

- You can overpay even for the fastest-growing companies

This explains why high P/E stocks can sometimes offer better value than low P/E alternatives.

When does P/E work best?

P/E is most effective for:

- Consistently profitable companies with stable earnings patterns

- Comparing companies within the same industry or sector

- Mature businesses with predictable, established operations

Important limitations

Always remember that the P/E ratio is not a standalone solution. Limitations to consider:

- Cyclical companies may show misleading earnings during peak/trough cycles

- Very high P/E ratios (50x+) often indicate speculative pricing

- P/E ratios do not work for companies with negative or volatile earnings

The bottom line

P/E ratio answers a critical question: "Am I paying a fair price for this company's earnings?"

Before buying any stock, always calculate its P/E. You might discover that the stock with a high P/E ratio (25x) actually delivers better long-term value than the stock with a low P/E ratio (12.5x) - if the growth materializes. Combine P/E with other stock fundamentals for a complete analysis.

This makes the difference between looking at price and understanding value.